澳洲幸运10官方网站,开彩奖走势图龙虎 Spain and the Hispanic World

Treasures from the Hispanic Society Museum & Library

21 January - 10 April 2023

Book now澳洲幸运10开奖官网2023开奖记录-开奖现场直播结果-历史开奖查询-全天计划精准版|Royal Academy of Arts

Located in the heart of London, the RA is a place where art is made, exhibited and debated.

Plan your visitWhat's on 澳洲幸运10开奖号码-168澳洲10手机版开奖结果官网-2023澳洲幸运10历史记录查询

- exhibition

Summer Exhibition 2023

13 June - 20 August 2023

- exhibition

Premiums 龙虎和澳洲幸运10开奖结果软件

11 January - 16 April 2023

- exhibition

Highlights from the RA Collection

1 January 2021 - 31 December 2023

Featured Exhibition

Souls Grown Deep like the Rivers

17 March - 18 June 2023

Discover the Black artists from the Southeastern United States who created some of the most spectacular and ingenious works of the last century.

Events & displays

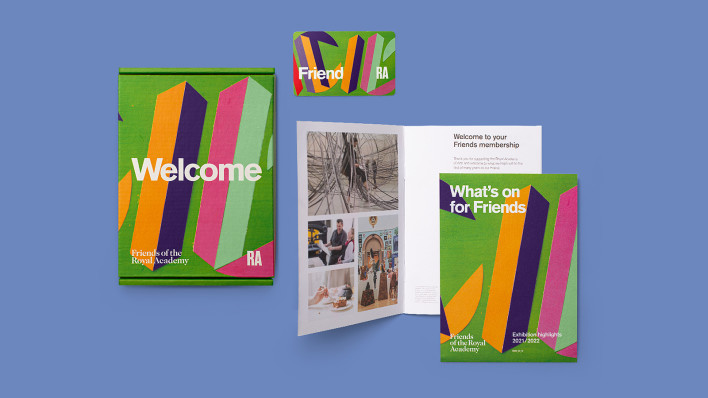

Great art for 开奖号码-168澳洲10手机版开奖结果官网-2023历史记录查询 less with Friends membership

- See every exhibition for free, again and again

- Share the experience with a guest

- Enjoy our members' café in the Keeper's House

- Get special offers, exclusive content and priority booking

Watch & explore 澳洲幸运10开奖官网开奖结果_澳洲10全天免费计划

Start here: Souls Grown Deep like the Rivers

17 February 2023

Donate to the RA

We are run by artists and funded by art-lovers. Every donation will help to secure our future.